Our operating context

The economy is still reeling from the effects of the COVID-19 pandemic and trading conditions such as lower business confidence, supply shortages, load shedding, inflationary pressures, foreign exchange volatility, civil unrest, the high cost of fuel, flooding, poverty, high unemployment, and the recent Ukraine-Russia war affected major supply industries. Economic recovery is likely to be slow across all markets and would require significant investment to stimulate growth. Our Group operated within this context in addition to unique challenges as the banking issues we currently face. It was our focus to stabilise the business within this tough context and preserve value for all our stakeholders.

The health, safety, and well-being – including the mental health of employees and “the new way of work” – remain a key priority for us.

During the year, the Board had to review its operational plans towards achieving its strategy and objectives, identifying crucial focus areas, and modernising our infrastructure.

Our executive management was responsible for developing and refining the Company’s strategy, in collaboration with the Board, through observing the volatile Macroeconomic environment and regularly assessing the short- to medium term impact on our business. This included evaluating external factors, liquidity of our clients, our cash requirements, and ways to contain costs. In addition, executive management was responsible for implementing the strategy with the Board’s oversight. The strategy includes the impact on the six capitals, the risks and opportunities facing the Company, and how the strategy is underpinned by the principles of sustainability and stewardship.

Creating value through relationships

Our report extends beyond financial reporting and includes non-financial performance, opportunities, risks, and outcomes attributable to or associated with our key stakeholders. Our financial performance is a result of how we interacted with all our various stakeholders.

The Group had challenges in its relationship with banking institutions, and we engaged with banking institutions in this regard and kept all our stakeholders abreast of developments in these engagements. We maintained communication with the JSE on listing and regulatory issues throughout the year, seeking their advice on transactions and responding to any concerns raised.

Our engagement with suppliers enabled us to ensure consistent delivery of products and services and better manage our working capital through negotiated terms. We also supported our suppliers by making payments on time. Our clients partnered with us and ensured that they paid us on time, which helped us manage our liquidity. Our commitment to creating strong bonds with our stakeholders based on mutual respect and understanding remains unwavering.

Through our various operations, we will continue to explore opportunities to maximise our Group’s capital and operational efficiencies and play our part in creating long-term stakeholder value.

Material matters impacting our strategy

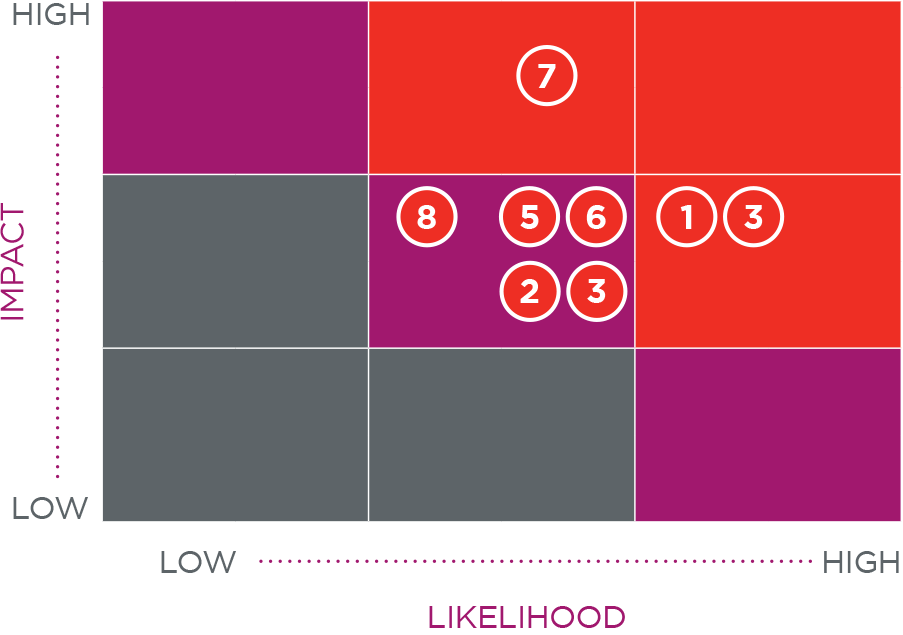

The 2022 financial year was characterised by uncertain geopolitical and socioeconomic growth factors, a challenging operating environment, evolving stakeholder needs and low growth, which has impacted our strategy. Our materiality process includes identifying, assessing, compiling, prioritising, deliberating, applying and validating our material matters and developments that have the potential to impact our sustainability.